In uncertain times like those we are currently experiencing, what could be the path forward for the furniture sector? According to data from CSIL Milano, the global furniture market closed 2024 with a value of USD 537.9 billion (wholesale value for furniture and lighting). The market is basically stable, with the Asia-Pacific region driving growth in the contract segment.

The global furniture market in 2025 is distributed as follows: Europe is worth USD 139 billion, equal to 26%, with a growth rate of -1% in 2024. North America is worth USD 132 billion, 25% of the total, with stable growth; Asia-Pacific is worth USD 212 billion, which is 39% of the global market, also down by 1% in 2024; finally, the rest of the world is worth USD 55 billion, 10% of the total.

The Furniture Export

In 2024, over 50% of global furniture production originated from the Asia-Pacific region, with China leading. About 40% of globally produced furniture is exported. China, Vietnam, Poland, Italy, and Germany are the top exporters, while the U.S., Germany, the UK, France, and Canada - together accounting for 50% of global furniture imports - are the leading importers. Trade is increasingly regionalized, with 75% of intra-European trade, and around 60% of global trade now taking place within economic blocs.

Key drivers for growth

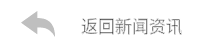

Amid these dynamics, the global furniture market is expected to grow at a CAGR of 5.29% until 2030. Key growth drivers include the expansion of e-commerce, digital transformation, and increased focus on sustainability, while supply chain disruptions and tariff barriers remain limiting factors.

But what are the drivers that push growth? Let’s start with the geographic areas. In the mass-market sector, between 2025 and 2030, high-growth markets include India (CAGR 8.80%), GCC countries (7.30%), Africa (2.79%), and the USA (3.16%). Europe will grow by 3.52%; Italy, Poland, and Germany are the areas where the premium segment will see the highest increase in the world.

Key drivers shaping the furniture market include, of course, urbanization, with more people moving into smaller urban spaces, and therefore requiring flexible, modular, and functional furniture. Sustainability will gain more traction as Generation Z, who favour eco-conscious designs using recycled and certified materials, become active furniture buyers.

Digital transformation could greatly support sustainability. In fact, the furniture industry is still a relatively backward industry, and only 20% of companies globally have a clear road map towards digitalization; 80% have just begun the journey or do not yet have a clear strategy for digitalizing their businesses. Yet digitalization could lead to a much more efficient industrial cycle, and therefore to a much more sustainable supply chain.

Distribution and e-commerce

Digitalization includes e-commerce, which currently reaches 26% of the market in Europe and 30% in the rest of the world, and is expected to reach 40% by 2030. The sales, marketing and communication are already undergoing a substantial transformation. However, the impact on distribution also depends on the geographical area being targeted. Depending on different world areas, the age of the target audience can vary. Thus, it’s useful to analyse the age range being targeted, as purchasing behaviours differ from one generation to the next.

Baby Boomers - who represent 33% of the market in Europe and North America - have very different habits from Gen Z. The largest part of the market is made up of Gen X (31%) and Millennials (27%), with Gen Z still making up only 9% of global buyers. For each age group, purchasing behaviours change, which is why it's important to consider the market segment distribution by geographic area. The factor that unites all age groups and all regions is the continued demand for a physical touchpoint, which remains essential.

Emerging trends

Among the emerging trends – and directly connected to digitalization – is social commerce. The social media experience increasingly turns into a purchase directly from the platform, so it’s more and more necessary to maintain a presence on these platforms, which can also yield a lot of useful data. The integration between physical and digital touchpoints is stimulating AR/VR integration in both e-commerce and physical stores.

Circular economy is also becoming more prevalent in furniture products, with more sustainable materials. These range from bamboo to bioplastics (both new and recycled), and to the reuse and recycling of many post-consumer materials (wood, steel, glass, aluminium).

Significant shares of the furniture market are also held by Ready-To-Assemble (RTA) furniture. Finally, smart furniture is on the rise – for example, mattresses with integrated apps for perfect sleep.

by Roberta Mutti